The Virginia Automatic Merchandising Association exists to promote the best interests of the vending industry, foster fair and free competition, provide a forum for exchanging ideas and suggestions for the benefit of the industry and that of the general public, enhance your professionalism and improve the performance of the company you represent.

____________________________________________________________________________________________________________________

If you are unable to join or renew your dues online, please choose from the following printable membership materials.

2024 VAMA Scholarship

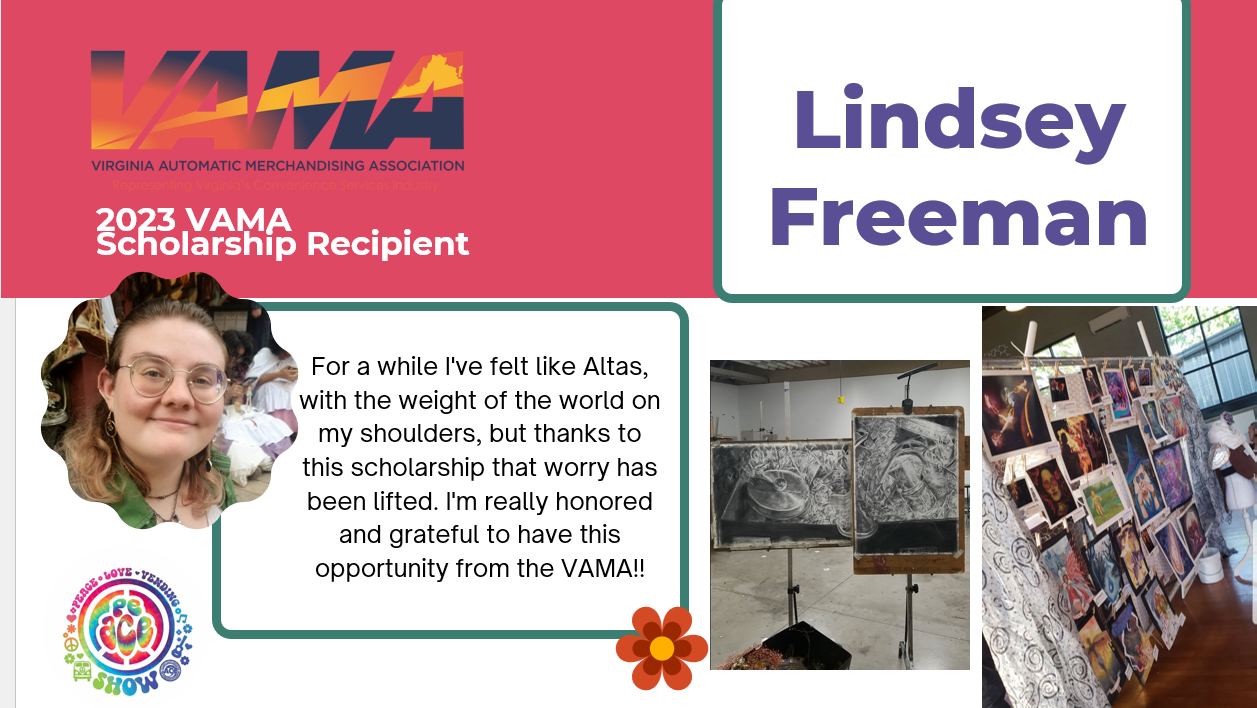

Do you have student looking for scholarship funds? VAMA gives back to our industry every year with TWO $1500 scholarships! 2024 winners will be announced at the ACE show on Oct. 12, 2024. Applications MUST be fully completed and submitted by fax or email by August 1, 2024.

2024/25 Scholarship Application 2023/24 Scholarship RecipientsCongrats to the 2023/24 VAMA scholarship recipients Isabella Russo and Lindsey Freeman! We wish you both the best in your future endeavors!

|

_____________________________________________________________________________________________________________________________ |

2023 VOY and SOY Award

Congrats to Rick Rayburn, 2023 VAMA Supplier of the Year and Chant Connock, VAMA's Vendor of the Year! Both winners were nominated by their peers in the VA vending industry for their distinguished service to the industry.

2023 Route Driver of the YearKathy Stertz was selected by the VA industry to receive VAMA's 2023 Route Driver of the Year award - Congrats, Kathy!

|

Top Membership Benefits

- Representation and visibility against legislative issues – stay informed on key issues.

- Networking opportunities with industry leaders and VAMA social and educational events.

- Links to Atlantic Coast Exposition for a large, regional vending show – Professional Development growth.

- Strength and bonding relationships with suppliers.

- Cutting edge educational opportunities.

- Reliable and trustworthy industry business information (especially for new owners).

- Equal voice no matter of business size.

- Customer credibility as a legitimate operating business.

- Learning and collaboration of a changing industry.

- Working relationships with surrounding state associations.

- Public Relations - Enjoy the benefits news and feature material, media response.

_____________________________________________________________________________________________________________________________ |

Join Us at the ACE Show!October 10-12, 2024 |